About Sotera

Sotera brings data-driven underwriting and loss selection to Fine Art & Specie and High Net-Worth Home Contents insurance by introducing item level risk analysis and sophisticated data modelling for the first time.

Sotera’s granular data analysis reveals hidden risks and opportunities in policies and portfolios, leading to more accurate and profitable underwriting for insurers, and better insurance for customers.

Sotera was founded at the University of Cambridge out of the Accelerate Program at Judge Business School. It was developed at Lloyds Lab, and has received investment from Lloyd's of London, Tokio Marine Future Fund, Ninety, Storyhouse Ventures, and a group of leading angel investors.

Sotera is designed and built by experts in insurance catastrophe modelling who have worked closely with leading underwriters in the UK and US insurance markets to develop a product built in the market for the market.

Sotera Product

Bringing scientific data-driven underwriting to the market for the first time

Why now

Climate Change and geopolitical uncertainty means that the past is no longer a reliable predictor of future risk. Insurers can no longer rely on historical claims data to predict insurance risk. We address this by applying data and technology to model risk forward, based on a real understanding of the policy schedule, the risk characteristics of the objects in it, and how they are affected by the location risks around them. This represents a significant innovation for this insurance market globally

How it works

The Sotera analysis system was inspired by catastrophe modelling. The system analyses the risk of each item in a policy based on its specific risk characteristics and its location. Using this analysis we then (randomly) simulate hypothetical events that lead to claims, and calculate insurance losses. Using up to half a million simulations, we produce a wide range of statistics for insurers from the full claims distribution, including, annual average loss (AAL), standard deviations (SD) and any quantile

How this changes insurance

It is not possible for a human to meaningfully read and make sense of a museum policy consisting of tens of thousands of very different objects. It is just as hard to understand the risk of a high value home contents schedule spread across several properties. Risk is very nuanced, and small changes within collections can have big impacts. Our system brings scientific modelling and data to this insurance class for the first time, providing a level of data analysis insurers have not seen before. Ultimately this supports better insurance decisions, leading to more profitable insurance business and better policies for customers

Sotera in Detail

Sotera Overview Video

Team

Elizabeth Marston - Co-Founder

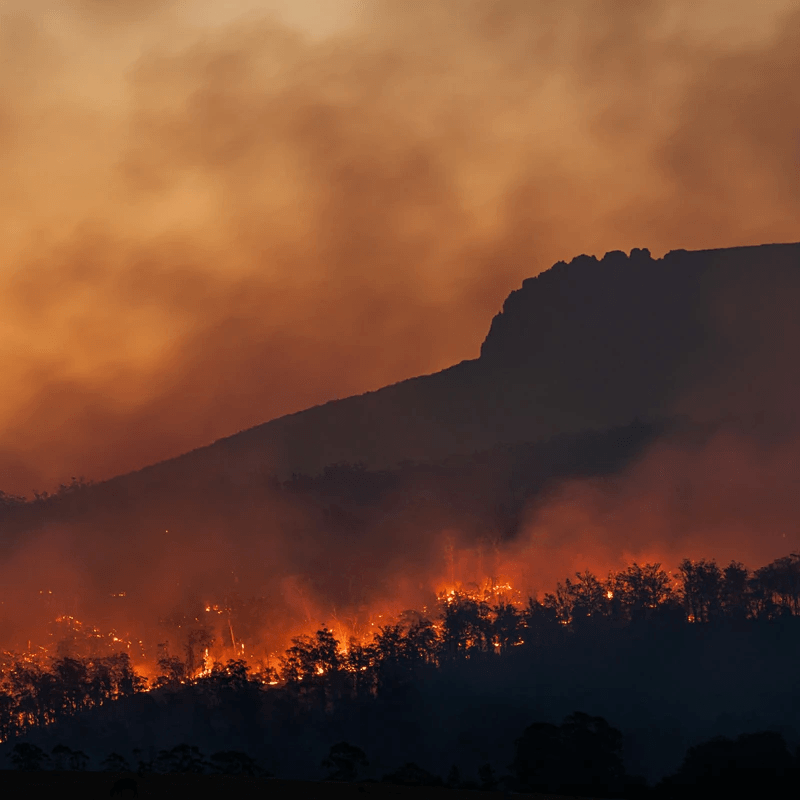

Liz started Sotera after her home was completely destroyed in the California Wildfires. The underwriters had no idea what had been in her home and the risk premium had been calculated based on generalities rather than details. She spent years trying to prove what was in her property after it had been burned down. Liz has 25 years of international business, combined with two recent masters degrees in Egyptology and Archaeology at the University of Cambridge. She worked on protecting artefacts at the British Museum, which first got her interested in how to use technology to understand risk relating to high value objects.

Tobias Stone - Co-Founder

Tobias joined Sotera after struggling with broken systems to buy suitable home contents insurance. As a tech entrepreneur who has seen how AI and data can improve commercial processes in a number of sectors, he wanted to develop a solution that would create a better customer experience. Tobias has a PhD in innovation, two degrees in archaeology and Egyptology, and 20 years experience in the tech sector, including specialising in high assurance digital identities, sitting on startup boards, and investing in early stage tech companies.

Dr Trevor Maynard - Senior Insurance Advisor

Trevor was Head of Exposure Management at Lloyd’s of London and designed the Lloyd’s Catastrophe Model. He wrote his PhD on the use of scientific forecasts within insurance, exploring their use in pricing and capital setting. In 2018, as Head of Innovation at Lloyd’s, he founded the Lloyd’s Lab, their accelerator programme. Trevor has degrees in pure mathematics and over 30 years of experience in the financial services industry where he worked as an actuary in various risk modelling and reserving roles. He now advises Sotera on modelling and insurance and is also the Vice Chair of the Centre for Risk Studies at the Judge Business School, University of Cambridge.

Thomas Breitburd - Data Scientist

Thomas joined Sotera from his Masters in Data Science at the University of Cambridge. He has a long-standing interest in meteorology, and how data science and machine learning methods can be used in weather hazards prediction and how that ties into insurance. He is writing a PhD at the University of St Andrews on the use of AI to better understand combined weather extremes, and works at Sotera during his studies.

Contact

© 2025 Sotera